While it might not suffice for some investors, we assume it is great to see the Ithaca Energy plc (LON: ITH) share rate up 11% in a solitary quarter. But in reality the in 2015 hasn’t benefited the share rate. In reality the supply is down 17% in the in 2015, well listed below the marketplace return.

The current uptick of 5.9% can be a favorable indicator of points ahead, so allow’s have a look at historic basics.

View our most recent evaluation for Ithaca Energy

In his essay The Superinvestors of Graham- and-Doddsville Warren Buffett explained exactly how share costs do not constantly reasonably mirror the worth of a company. One incomplete however straightforward method to take into consideration exactly how the marketplace assumption of a business has actually changed is to contrast the modification in the incomes per share (EPS) with the share rate motion.

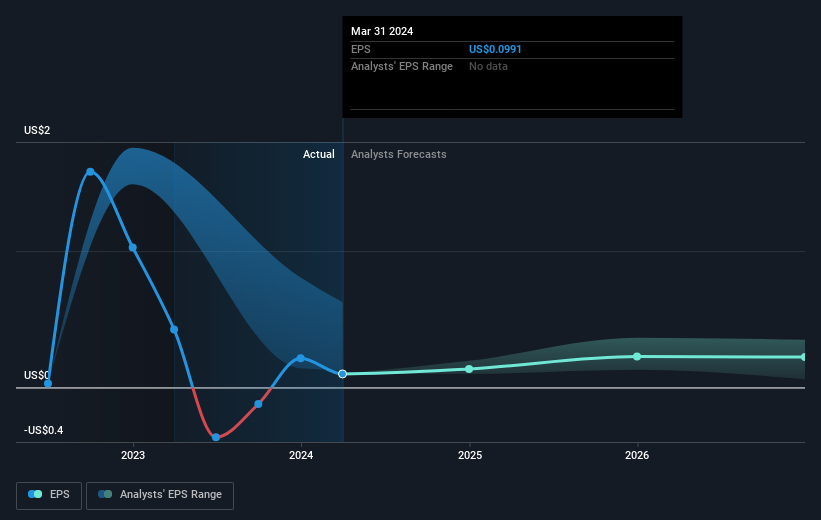

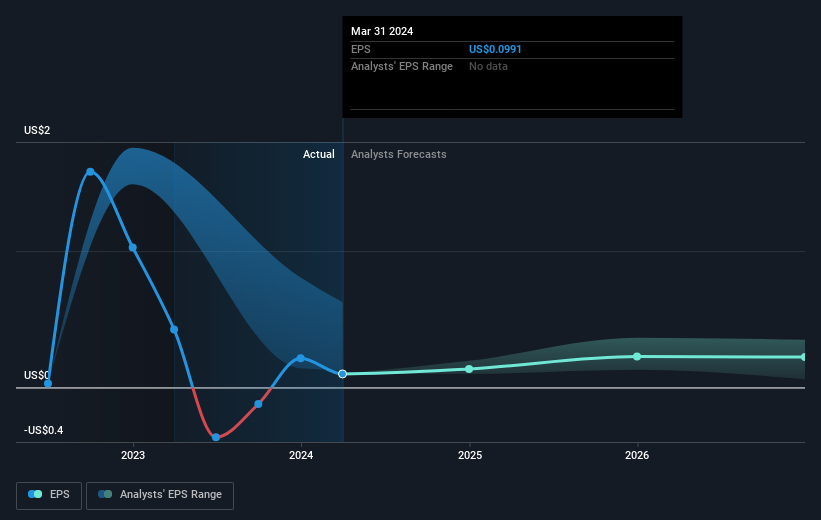

Ithaca Energy handled to raise incomes per share from a loss to a revenue, over the last year.

The result resembles a solid enhancement to us, so we’re stunned the marketplace has actually offered down the shares. If the enhanced success signifies points ahead, after that today might verify the ideal time to pop this supply on your watchlist.

The firm’s incomes per share (with time) is portrayed in the picture listed below (click to see the precise numbers).

It’s most likely worth keeping in mind that the chief executive officer is paid much less than the average at comparable sized firms. It’s constantly worth watching on chief executive officer pay, however a more crucial inquiry is whether the firm will certainly expand incomes throughout the years. Before acquiring or offering a supply, we constantly advise a close evaluation of historical development fads, offered below.

What About Dividends?

It is necessary to take into consideration the overall investor return, along with the share rate return, for any kind of offered supply. The TSR includes the worth of any kind of spin-offs or reduced funding raisings, in addition to any kind of rewards, based upon the presumption that the rewards are reinvested. Arguably, the TSR offers an extra thorough image of the return produced by a supply. In the instance of Ithaca Energy, it has a TSR of -4.1% for the last 1 year. That surpasses its share rate return that we formerly stated. And there’s no reward for presuming that the returns repayments greatly describe the aberration!

A Different Perspective

Given that the marketplace acquired 18% in the in 2015, Ithaca Energy investors could be miffed that they shed 4.1% (also consisting of rewards). While the objective is to do far better than that, it deserves remembering that also fantastic lasting financial investments in some cases underperform for a year or even more. It’s fantastic to see a good little 11% rebound in the last 3 months. Let’s simply wish this isn’t the widely-feared ‘dead feline bounce’ (which would certainly show more decreases ahead). It’s constantly fascinating to track share rate efficiency over the longer term. But to recognize Ithaca Energy much better, we require to take into consideration lots of various other variables. Consider threats, as an example. Every firm has them, and we have actually found 3 indication for Ithaca Energy you ought to understand about.

Of training course, you may discover a superb financial investment by looking in other places. So take a peek at this totally free checklist of firms we anticipate will certainly expand incomes.

Please note, the marketplace returns estimated in this short article mirror the marketplace weighted ordinary returns of supplies that presently trade on British exchanges.

Have responses on this short article? Concerned regarding the material? Get in contact with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This short article by Simply Wall St is basic in nature. We give discourse based upon historic information and expert projections just making use of an honest approach and our posts are not meant to be monetary suggestions. It does not comprise a referral to acquire or market any kind of supply, and does not gauge your purposes, or your monetary scenario. We objective to bring you lasting concentrated evaluation driven by basic information. Note that our evaluation might not consider the most recent price-sensitive firm news or qualitative product. Simply Wall St has no setting in any kind of supplies stated.