It’s clear that semiconductor provides have truly been particularly big victors amidst the professional system (AI) transformation. With share charges escalating, numerous top-level chip enterprise have truly gone with stock splits this yr. Some AI chip stock-split provides chances are you’ll acknowledge include Nvidia ( NASDAQ: NVDA), Super Micro Computer ( NASDAQ: SMCI), and Broadcom ( NASDAQ: AVGO)

Indeed, every of those provides has truly completed marvels for plenty of profiles over the past variety of years. However, I see amongst these chip provides because the exceptional choice over its friends.

Let’s injury down the entire photograph at Nvidia, Supermicro, and Broadcom and set up which AI chip stock-split provide might be the perfect buy-and-hold probability for lasting capitalists.

1. Nvidia

For the final 2 years, Nvidia has truly not simply been the best title within the chip space nevertheless moreover principally turned one of the best scale of AI want at big. The enterprise focuses on creating modern chips, known as graphics refining gadgets (GPUs), and knowledge facility options. Moreover, Nvidia’s compute unified device architecture (CUDA) offers a software program program aspect that may made use of along with its GPUs, providing the enterprise with a wonderful and worthwhile end-to-end AI neighborhood.

While all that appears implausible, capitalists can’t pay for to be starry-eyed because of Nvidia’s present supremacy. The desk listed under breaks down Nvidia’s earnings and free-cash-flow improvement fads over the past numerous quarters.

|

Category |

Q2 2023 |

Q3 2023 |

This fall 2023 |

Q1 2024 |

Q2 2024 |

|---|---|---|---|---|---|

|

Revenue |

101% |

206% |

265% |

262% |

122% |

|

Free capital |

634% |

Not product |

553% |

473% |

125% |

Data useful resource: Nvidia Investor Relations.

Admittedly, it’s tough to toss shade on a agency that’s frequently offering triple-digit earnings and income improvement. My fear about Nvidia is just not related to the diploma of its improvement nevertheless as an alternative its fee.

For the enterprise’s 2nd quarter of financial 2025 (completed July 28), Nvidia’s earnings and cost-free capital climbed 122% and 125% yr over yr, particularly. This is a noteworthy stagnation from the final numerous quarters. It’s affordable to clarify that the semiconductor sector is intermittent, and a side like that may have an effect on improvement in any kind of offered quarter. Unfortunately, I imagine there’s much more underneath the floor space with Nvidia.

Namely, Nvidia encounters growing rivals from straight sector pressures, reminiscent of Advanced Micro Devices, and digressive risks from its shoppers– notably, Tesla, Meta, andAmazon In idea, as rivals within the chip space will increase, shoppers will definitely have additional decisions.

This leaves Nvidia with a lot much less make the most of, which can doubtless reduce a number of of its costs energy. In the long run, this may take a major toll on Nvidia’s earnings and income improvement. For these elements, capitalists might intend to consider some choices to Nvidia.

2. Super Micro Computer

Supermicro is an IT design enterprise concentrating on creating net server shelfs and numerous different framework for data amenities. In present years, skyrocketing want for semiconductor chips and knowledge facility options has truly labored as a bellwether forSupermicro Moreover, the enterprise’s shut partnership with Nvidia has truly confirmed particularly advantageous.

That acknowledged, I’ve some curiosity inSupermicro As a amenities firm, the enterprise relies upon tremendously on numerous different enterprise’ capital funding calls for. This makes Supermicro’s improvement in danger to outdoors variables, reminiscent of want for data facility options, chips, net server shelfs, and additional. Furthermore, Supermicro is far from the one IT design professional in the marketplace.

Competition from Dell, Hewlett Packard, and Lenovo (merely amongst others) deliver their very personal levels of expertise to the trade. As an final result of finishing in such a commoditized atmosphere, Supermicro might be required to contend on fee– which takes a toll on income era.

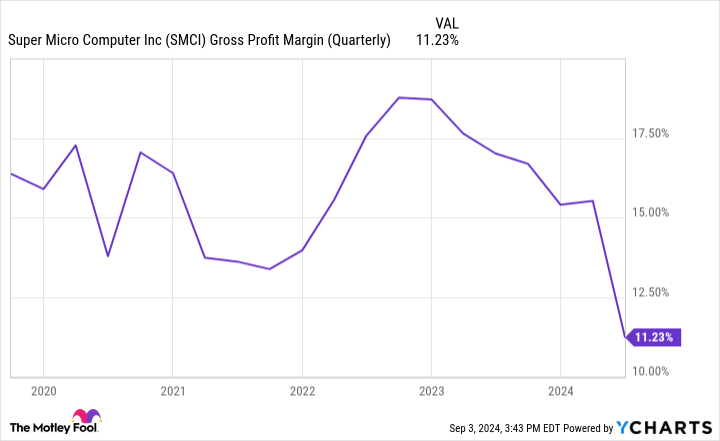

Infrastructure firms don’t deliver the exact same margin account as software program utility enterprise, for example. Given that the enterprise’s gross margins are quite lowered and in lower, capitalists ought to beware. While Supermicro’s monitoring tried to ensure capitalists that the margin degeneration is the result of some logjams within the provide chain, additional present data might signify that gross margin is the least of the enterprise’s points.

Supermicro was only recently the goal of a quick document launched byHindenburg Research Hindenburg declares that Supermicro’s audit strategies have some imperfections. Following the temporary document, Supermicro reacted in a information launch laying out that the enterprise is suspending its yearly declare 2024.

Given the changability of want leads, an ever-changing margin and income dynamic, and the accusations bordering its audit strategies, I imagine capitalists at the moment have significantly better decisions within the chip space.

3. Broadcom

By process of elimination, it’s clear that Broadcom is my main buy-and-hold choice amongst chip provides now. This is just not as a result of Broadcom’s returns this yr have truly delayed its equivalents, nevertheless. The underlying elements Broadcom’s shares have truly pale contrasted to varied different chip provides can why I imagine its best days are upfront.

I see Broadcom as an additional different firm than Nvidia andSupermicro The enterprise runs all through a number of improvement markets, consisting of semiconductors and framework software program utility. Grand View Research approximates that the general addressable marketplace for methods framework within the united state was valued at $136 billion again in 2021 and was readied to increase at a compound yearly improvement worth of 8.4% in between 2022 and 2030.

Systems framework consists of prospects in data amenities, interactions, cloud laptop, and additional. Considering corporations of all dimensions are progressively relying on digital framework to make data-driven decisions, I see the perform Broadcom performs in community safety and connection as a major probability and imagine its present buy of VMware is very sensible and will definitely help open brand-new improvement capability.

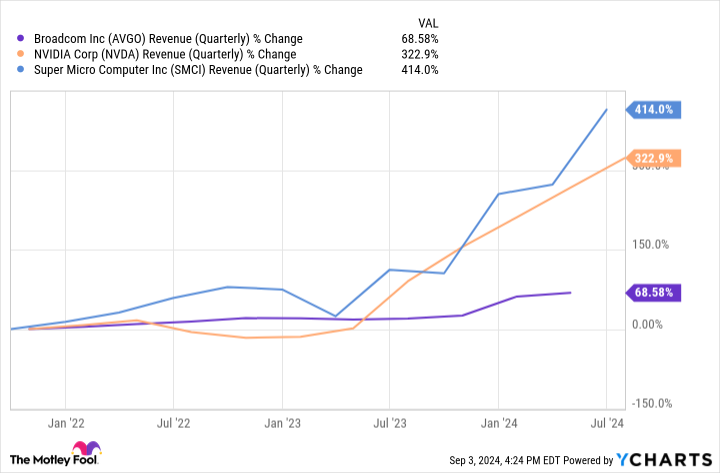

If you check out the event fads within the graph above, it’s evident that Broadcom is just not experiencing the exact same diploma of want as Nvidia and Supermicro now. I imagine that is since Broadcom’s placement within the extra complete AI world is but to expertise proportionate improvement contrasted to getting chips and cupboard space companies in droves.

While I’m not stating Nvidia or Supermicro are unhealthy choices, I imagine their futures look cloudier than Broadcom’s now. I feel Broadcom stays within the extraordinarily onset of a brand-new improvement frontier together with a number of motifs (with AI being merely amongst them). For these elements, I see Broadcom as the perfect different checked out on this merchandise and imagine lasting capitalists have a worthwhile probability to scoop up shares and grasp on restricted.

Should you spend $1,000 in Broadcom now?

Before you get provide in Broadcom, take into account this:

The Motley Fool Stock Advisor professional group merely acknowledged what they assume are the 10 best stocks for capitalists to get at the moment … and Broadcom had not been amongst them. The 10 provides that made it will probably generate beast returns within the coming years.

Consider when Nvidia made this guidelines on April 15, 2005 … in case you spent $1,000 on the time of our referral, you would definitely have $630,099! *

Stock Advisor offers capitalists with an easy-to-follow plan for fulfillment, consisting of help on developing a profile, regular updates from specialists, and a pair of brand-new provide decisions month-to-month. The Stock Advisor answer has better than quadrupled the return of S&P 500 as a result of 2002 *.

*Stock Advisor returns since September 3, 2024

John Mackey, earlier chief govt officer of Whole Foods Market, an Amazon subsidiary, belongs to The Motley Fool’s board of supervisors. Randi Zuckerberg, a earlier supervisor of market development and spokesperson for Facebook and sibling to Meta Platforms CHIEF EXECUTIVE OFFICER Mark Zuckerberg, belongs to The Motley Fool’s board of supervisors. Adam Spatacco has settings in Amazon, Meta Platforms, Nvidia, andTesla The Motley Fool has settings in and advises Advanced Micro Devices, Amazon, Meta Platforms, Nvidia, andTesla The Motley Fool advisesBroadcom The Motley Fool has a disclosure policy.

Nvidia, Super Micro, or Broadcom? Meet the Artificial Intelligence (AI) Stock-Split Stock I Think Is the Best Buy and Hold Over the Next 10 Years. was initially launched by The Motley Fool